Nominal Risk Free Rate Symbol - If an interest rate is 10% = 0.1; Many analysts will use the 10 year yield as the risk free rate when valuing the markets or an individual security.

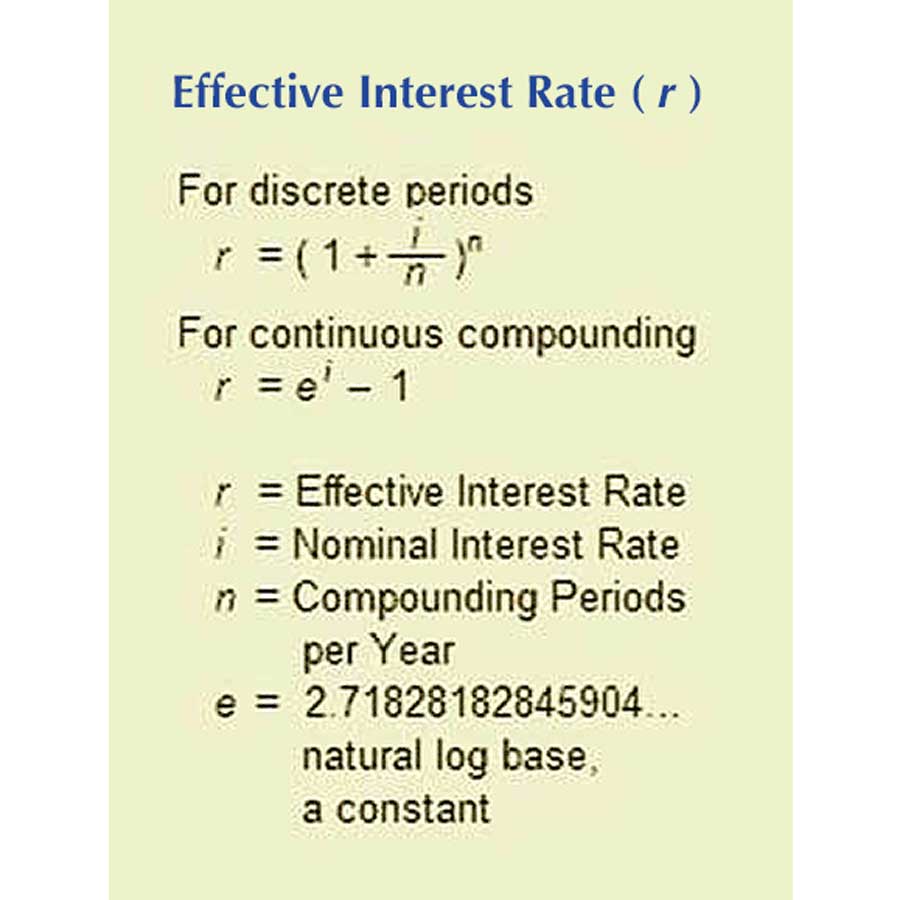

How To Calculate Interest Compounding For Exponential Growth

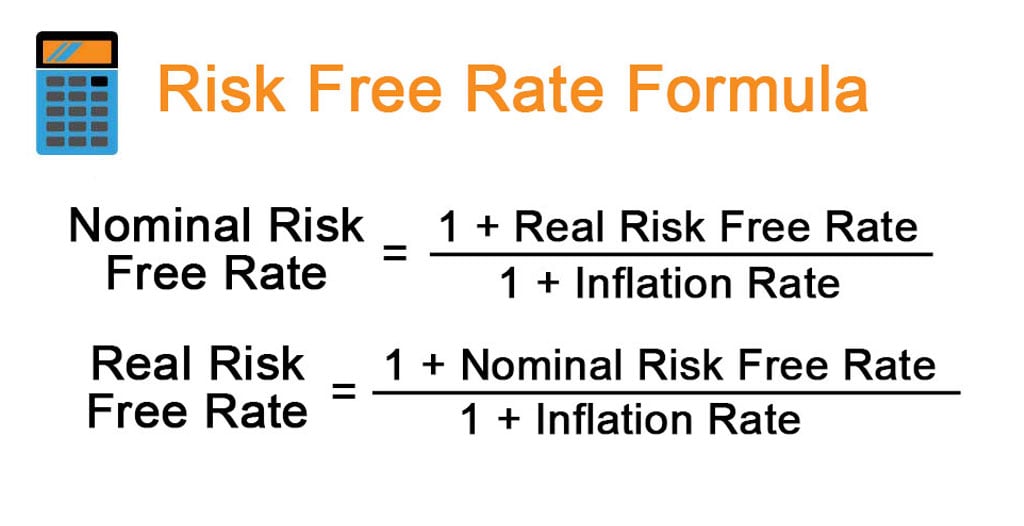

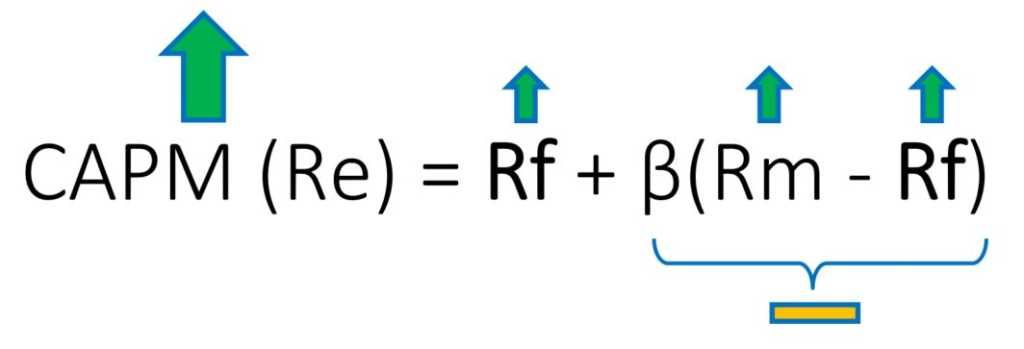

One parameter that is needed in the equations is the risk free interest rate.

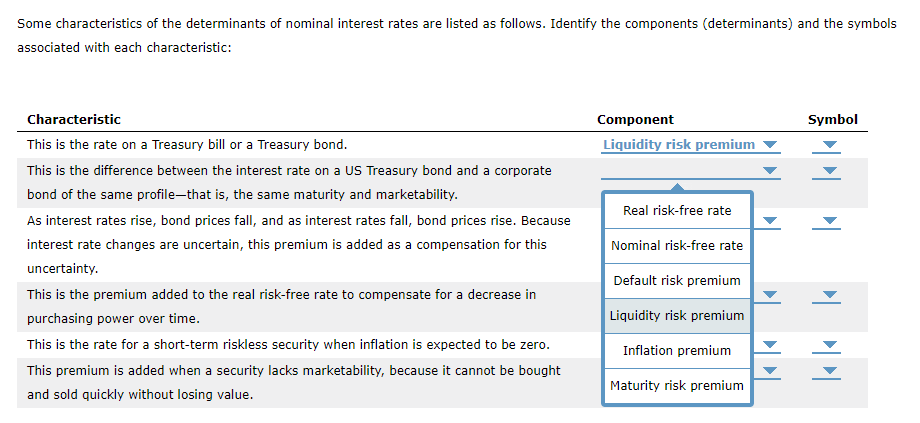

Nominal risk free rate symbol. Nominal risk free rate, inflation premium, real risk free rate, maturity risk premium, default risk premium, and liquidity risk premium. Nominal interest rate is the interest rate before taking inflation into account, in contrast to real interest rates and effective interest rates. 0.1 / 0.03 = 3.333333 1.1 / 1.03 = 1.0679 in one case you come up with 333% in one case you come up with 106%.

Some characteristics of the determinants of nominal interest rates are listed as follows. Nidha, think about it.10 yr duration is too long. Historically, the 10 year treasury rate reached 15.84% in 1981 as the fed raised benchmark rates in an effort to contain inflation.

If we have the nominal interest rate and we want to work out the real interest rate, we just need to rearrange the above expression: Treasury securities, assuming there is no inflation: Characteristic component quidity risk premium symbol it changes over time, depending on the expected rate of return on productive assets exchanged among market participants and people's time.

I will do a backtest on historical data. You subtract 1 to remove what would be the principle so you're back to focusing. Lower steady higher minimum the annual rate of inflation is 1.5%.

What is the real value of the projected payment in three years? Also, interest rates follow inflation rather than the other way round i.e. It is calculated by adding the inflation premium to r*:

Qe does not cause inflation. I can see that different rates affects the theta value much. Too many sooks spoil the coup:

Then i would like to put in the risk free interest rate that was on that particular date in the backtest to be so accurate as possible. Default risk premium when the development date is set for a long period of time, the default risk premium is at its lowest. And inflation is 3% = 0.03.

Identify the components (determinants) and the symbols associated with each characteristic: Additional return to compensate for additional risk It is usually closer to the base rate of a central bank and may differ for the different investors.

More what the annual percentage rate (apr) tells you For the symbol it states. The less frequently the security is traded, the higher the premium added, thus increasing the.

The nominal interest rate is 8%. It is the rate of interest offered on.

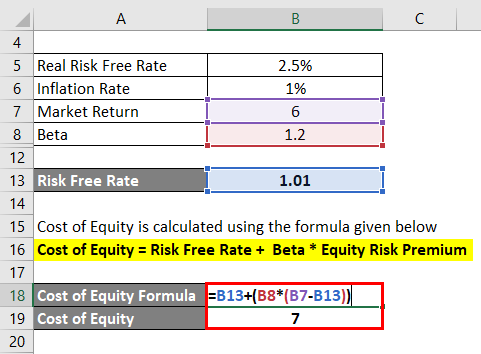

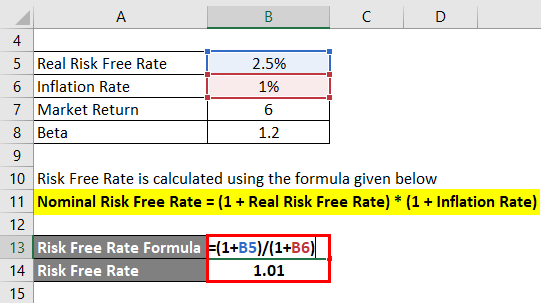

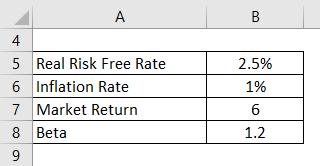

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Solved Some Characteristics Of The Determinants Of Nominal Cheggcom

Solved Some Characteristics Of The Determinants Of Nominal Cheggcom

Solved Hi For The Component It States Nominal Risk Free Cheggcom

Risk-free Rate - Know The Impact Of Risk-free Rate On Capm

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Solved - Some Characteristics Of The Determinants Of Nominal Interest Rates - 1 Answer Transtutors

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Is-lm Uneasy Money Page 2

Interest Rates And Required Returns Interest Rate Fundamentals - Ppt Download

Nominal Stock Illustrations 918 Nominal Stock Illustrations Vectors Clipart - Dreamstime

Solved Aa Aa 3 Determinants Of Market Interest Rates Some Cheggcom

5oixm-ctr_tvfm